Automatic Acquisition Plan

Your Roadmap To Financial Freedom

Imagine if you had a systematic, logical and most importantly, proven plan that you could rely on ensure your future financial security. Wouldn’t that be a weight off your mind? Think of how freely, comfortably and stress-free you’d live.

Fortunately, there IS such a method of wealth creation available.

Here at Universal Group, we’ve been investing in property for over 16 years and have refined an automated, proven system that leverages the fact that real estate doubles in value every 7-10 years. So while wealth doesn’t accumulate overnight, it is inevitable – all you need to do is capitalise on what historical data tells us!

An Automatic Acquisition Plan is the ultimate way to grow your wealth through real estate and assure yourself of an affluent future. Sticking to the plan is easy too, since it runs itself! With an AAP, life, stress or day-to-day issues won’t get in the way of the better tomorrows you’ve always planned.

“Wealth Creation Myths Debunked : Wealth creation is straightforward. The more property you can acquire in the next 7-10 years, the wealthier you will be a decade from now. Obvious, isn’t it?”

Here’s how to build a multi-million dollar property portfolio, regardless of where you currently stand…

The Proven, Automatic Method For Building A Multi-Million Dollar Property Portfolio

Universal Group’s Automatic Acquisition Plan (AAP)

Your 10 Year Portfolio Goal: Own 10 properties outright, giving you $300,000 per year in pure cashflow*

*The above figure of $300K is based on today’s terms, but remember, rents increase with inflation.

Firstly, don’t allow the bounds of possibility that may have previously constrained your lifestyle, to dupe you: this goal is readily achievable. With our systematic approach, we’ll show you how to automatically acquire 2 properties per year, for the next 10 years.

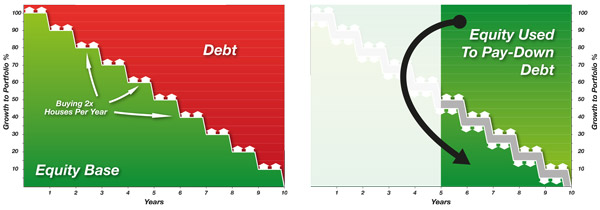

These 20 properties will increase in value, as statistical data shows. You will then sell the 10 oldest properties to minimise capital gains tax and using the profits, pay out the debt on the remaining 10 newer assets, to maximise depreciation. As a result, you will own 10 properties outright, with their rental cashflow used to sustain your lifestyle.

Buying 20 properties over the next 10 years might seem like a difficult task, however with an AAP, you have a proven system to follow, where all the possibilities have been played out many, many times before, dramatically reducing any risk. In fact, once you purchase your first two properties, the process will become very clear and your goal will quickly gain traction.

But, what should you buy? Again, the hard work has been done for you. Properties in a price bracket of approx $300,000 to $400,000 are ideal, since our strategy will include selling-down 10 of them to purchase the other 10. Because of this, the properties need to be in a price range that’s affordable for a broad range of people.

To illustrate the process financially: you’ll accumulate 20 properties over 10 years, with a total value of approximately $10,000,000. The 20 properties will cost approximately $7,000,000 (20 x $350,000) and accrue $3,000,000 in equity, due to natural market growth. All costs associated with the purchases will be subsidised against your income, so your $3,000,000 in equity will equate to approximately $300,000 a year in profit, across 10 years.

To reap the rewards of your automated plan, you’ll need to sell down the first 10 properties you purchased. The reason for doing this is that over the course of 10 years, you will have maximised your gains on the older assets and will pay less Capital Gains Tax. You’ll then use the profits from these sales to pay down the remaining mortgages on your newer properties, from which you can receive an ongoing rental income.

Also, keep in mind that as the market value of a property doubles over time, so too does its rental income. So initially you’ll be buying properties for $350,000, returning you a 6% yield (or $400/wk rent). However after 10 years, rents double, giving you $800/wk in pure cashflow from that same property.

It’s a sure-fire and inherently simple way to acquire the wealth you’ve always felt was out of reach – and it’s possible because you’ll be using a proven system that leverages the statistical inevitabilities of the real estate market.

Ready to get started? Fill out a Financial Snapshot and forward it to the Universal Group Team now! Or, read more about the Investor Menu Of Choice